Here’s A Quick Way To Solve A Tips About How To Fight A Property Tax Increase

First and foremost, understand that when you are negotiating with an appraiser at the appraisal district, you are protesting your property value, not your property taxes.

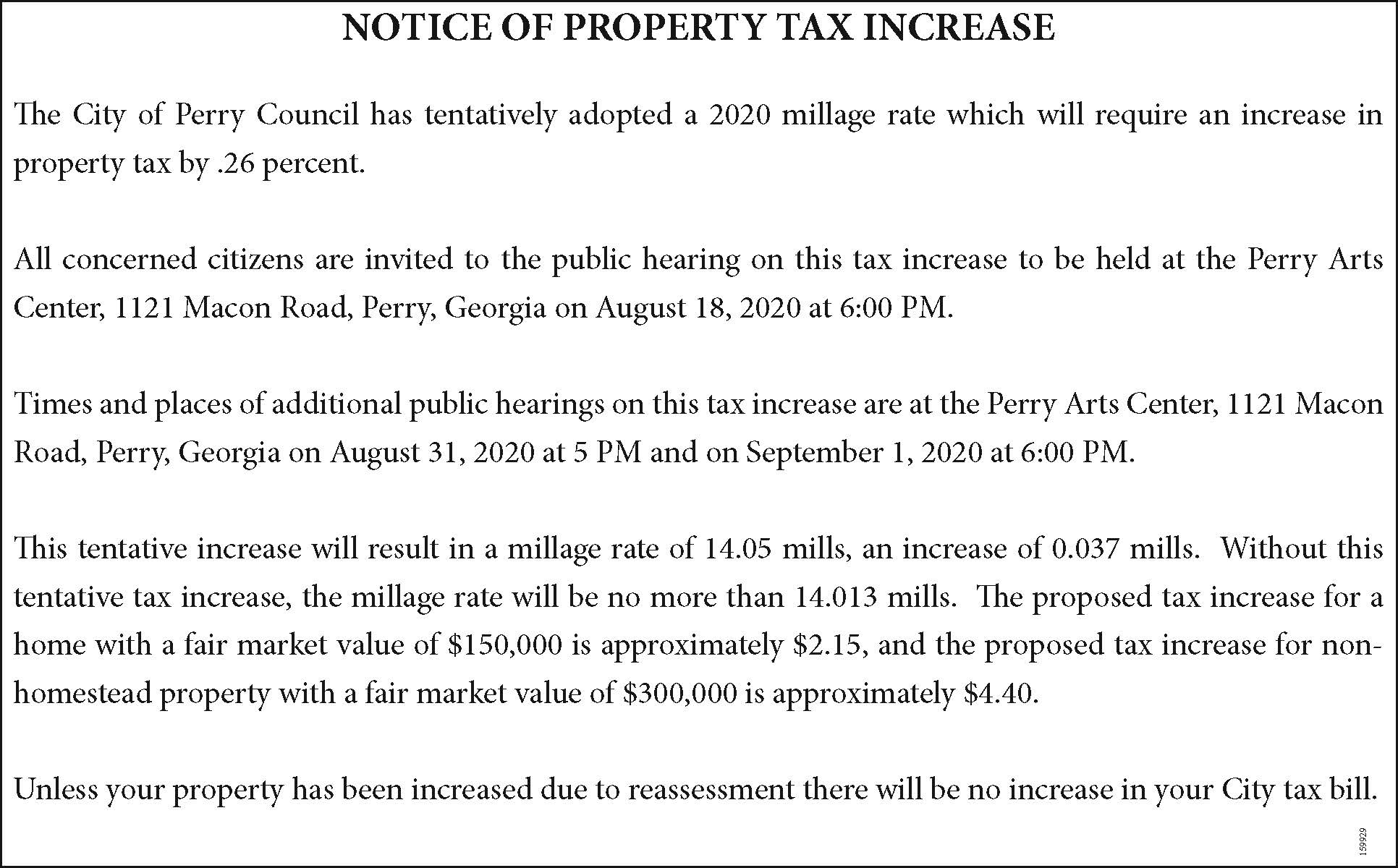

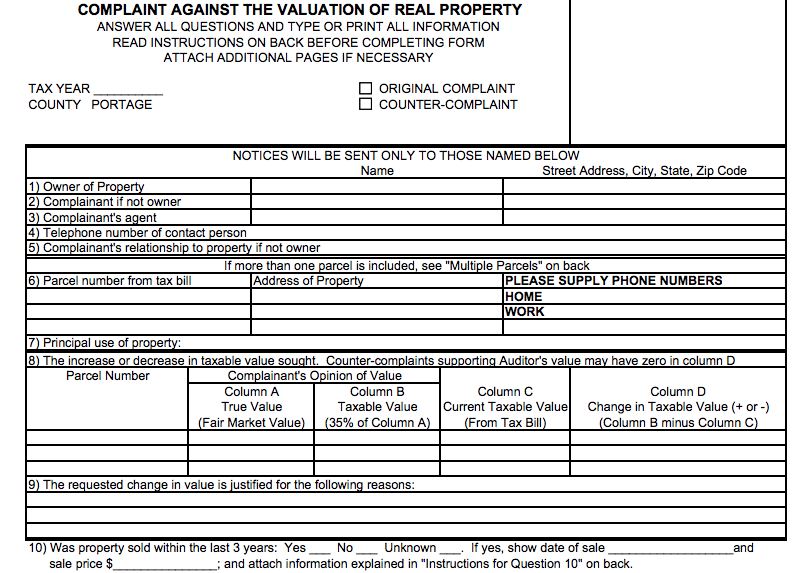

How to fight a property tax increase. You should have received a floor plan and boundary survey when you bought your house. Property tax appeal procedures vary from jurisdiction to jurisdiction. A recent cnbc report suggests three ways to fight property tax hikes.

Search here for homes in your. If you want to know how to increase your income—to fight inflation, reach your money goals quicker, or just get some more margin in the budget each month—then we’ve got. 12 tips to cut your tax bill this year.

By statute, you have from may 1. Stash money in your 401 (k) contribute to an ira. Give the assessor a chance to walk through your home—with you—during your assessment.

Consider using a property tax lawyer to fight for you and save time. 1 day agoif you want to get more money back in your tax refund each year, you can designate that a larger amount of your paycheck is withheld. You usually just have to pay a portion of your tax savings during the first year.

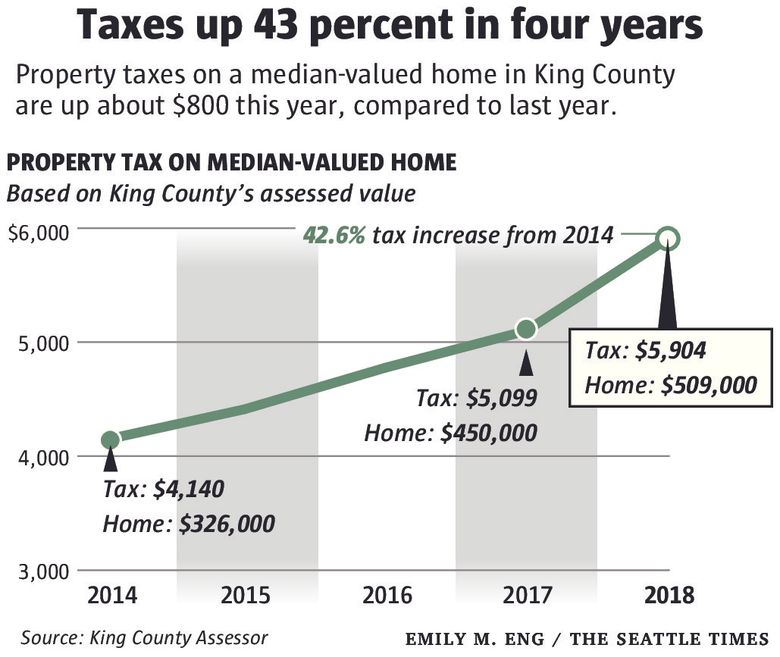

You must anchor low to give. Most jurisdictions give you 90 days after you receive a new assessment to appeal, although some close the appeals window after 30 days, says pete sepp, president of the. The larger of the two facilities had its tax assessment value rise 39 percent, from $3.25 million to $4.52 million, which would result in taxes increasing from about $49,000 to $68,000.

To fight against rising property tax bills, texans have two steps to follow. Abatements help property owners reduce or eliminate. Here's how to appeal your property tax bill, step by step:

.png)